tax reduction strategies for high income earners australia

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax.

Do Income Tax Increases On The Top 2 Of Earners Prevent Job Creation Quora

When you make a concessional.

. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to. Australia Current Situation In Control.

If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital. For those trying to learn how to save tax in Australia salary sacrificing is one way. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions.

In many cases the tax savings can be tens. Investing in lower income earning spouses name may be better. The first way you can reduce your taxable.

Leverage Home Sales Tax. Keeping savings in a. Deductions Work-related expenses Donations Superannuation contributions Work-related.

According to an analysis of countries around the world by. This rate is lower than the personal income tax rate. Tax reduction strategies for high income earners australia.

Tax reduction strategies for high income earners australia Thursday March 10 2022 Edit. Six tips for paying less tax. 15 Easy Ways to Reduce Your Taxable Income in Australia 1.

Specifically important numbers for 2022 include. Home australia reduction strategies tax. The higher your tax bracket the higher the benefits are of tax savings.

One of the most common tax-minimization strategies high net worth people use is one to which people of all income levels have access. Many Australian Tax Videos Are Discuss The Same BORING Strategies. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Contributing the maximum amount to. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Here are some of the most accessible tax reduction strategies that ATO allows.

Most of our Sydney clients are in the top 15 of earners in Australia. This is a tax-effective strategy because super contributions. High Income Financial Planning Reduce Tax and Build Wealth.

In all honesty taking advantage of a donor-advised fund is probably one of the best strategies to reduce taxes for high income earners because it allows you to take current. High Income earner in Australia have the most to gain. While the taxman is targeting investors hiding assets overseas there are much less complicated ways to cut your tax bill.

August 12 2014. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA.

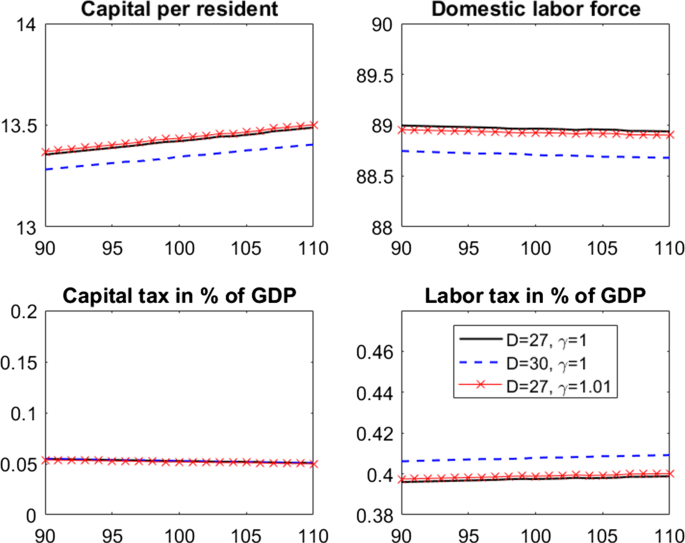

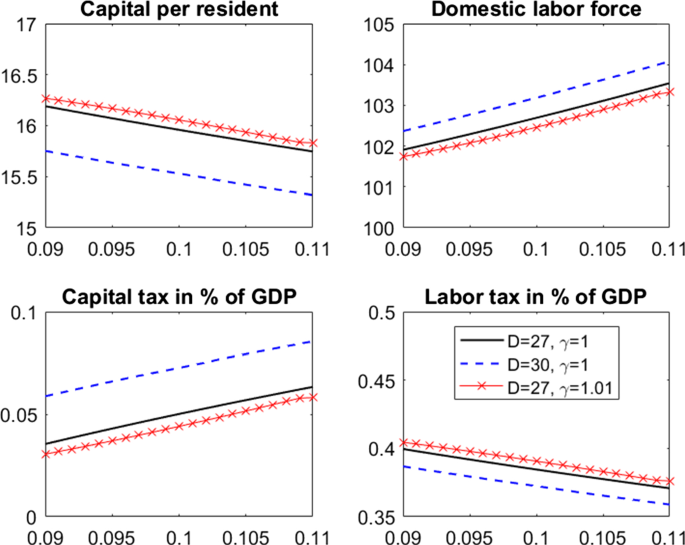

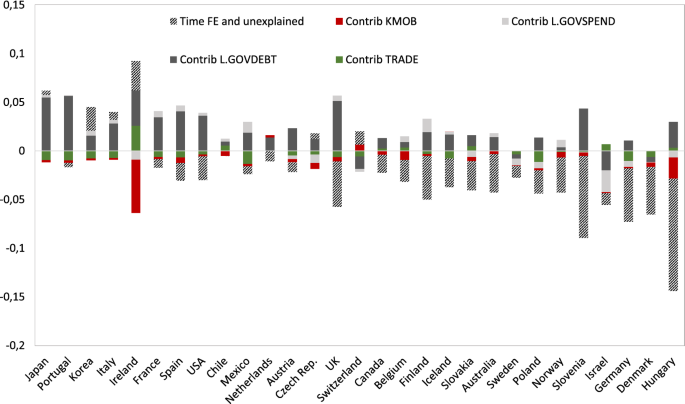

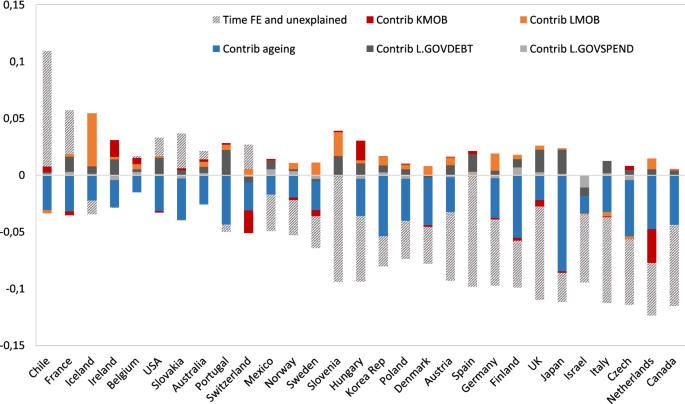

Taxing Capital And Labor When Both Factors Are Imperfectly Mobile Internationally Springerlink

Taxing Capital And Labor When Both Factors Are Imperfectly Mobile Internationally Springerlink

Payroll Tax Vs Income Tax What S The Difference Pherrus

Taxing Capital And Labor When Both Factors Are Imperfectly Mobile Internationally Springerlink

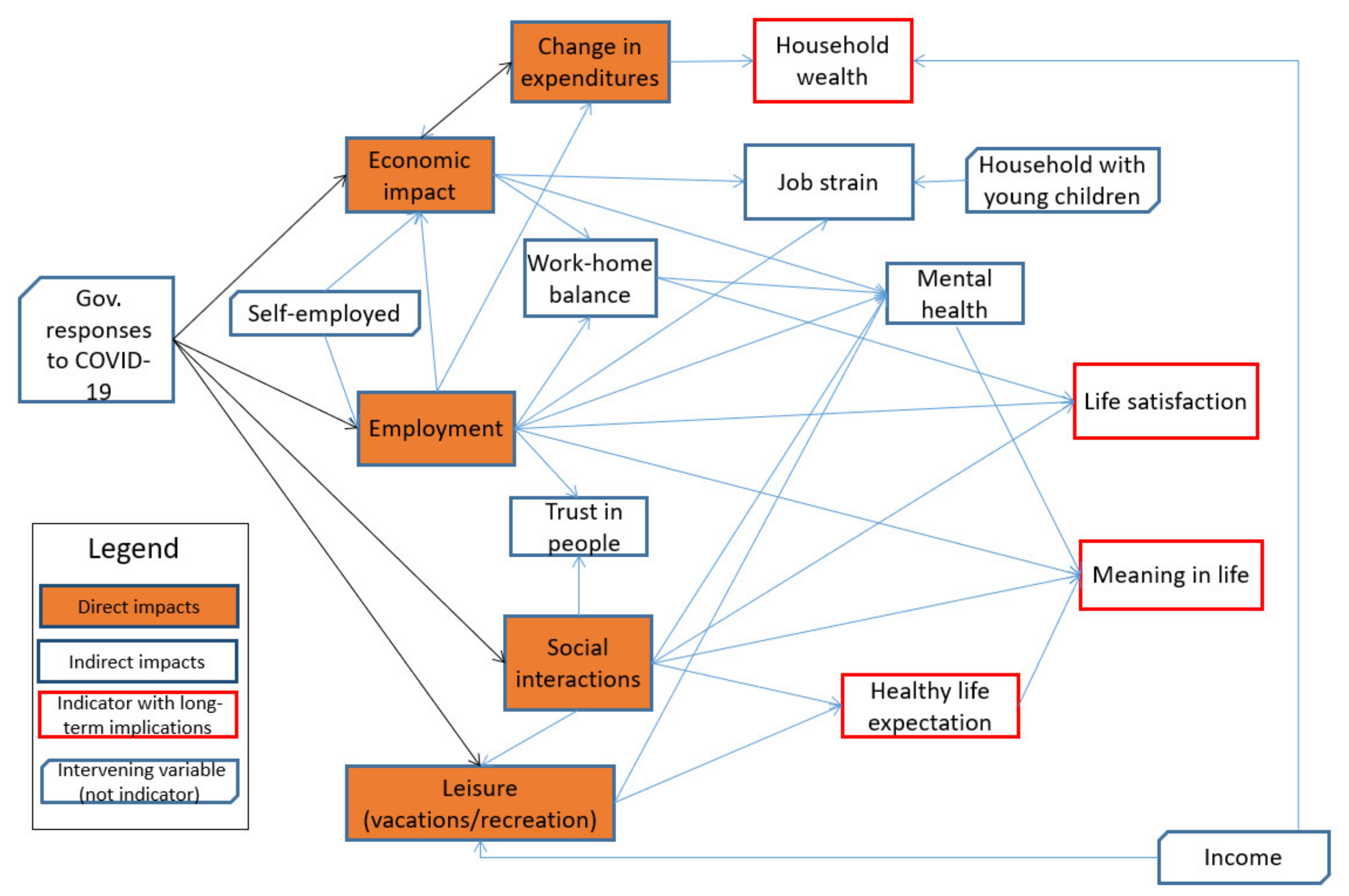

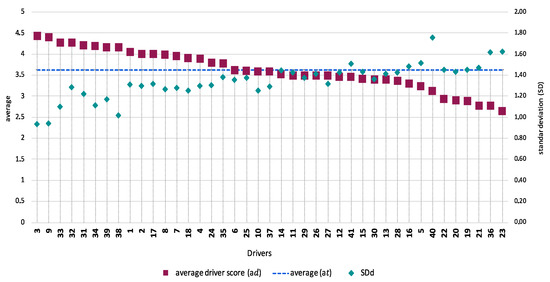

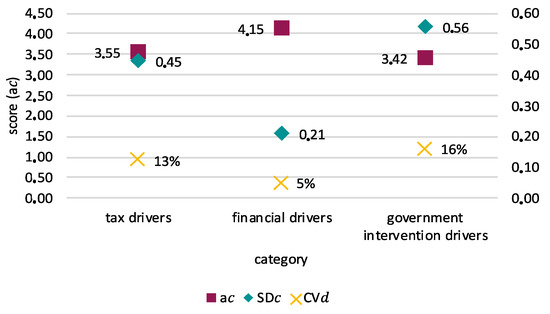

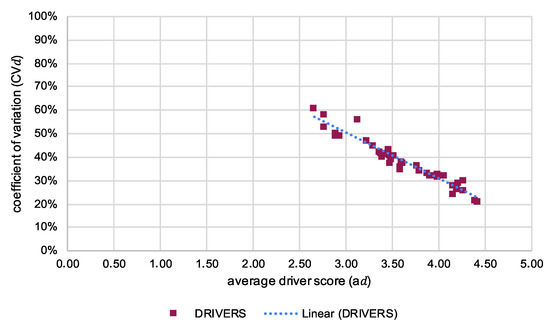

Sustainability Free Full Text Identifying Public Policies To Promote Sustainable Building A Proposal For Governmental Drivers Based On Stakeholder Perceptions Html

Sustainability Free Full Text Identifying Public Policies To Promote Sustainable Building A Proposal For Governmental Drivers Based On Stakeholder Perceptions Html

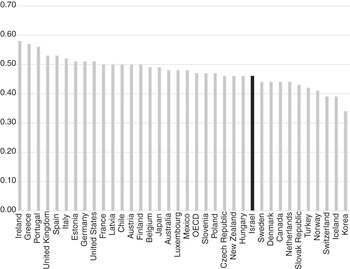

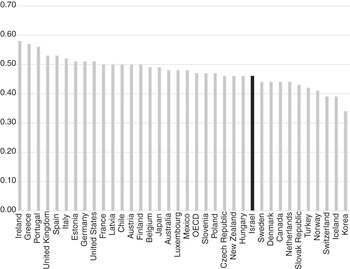

Pdf Trends In Top Incomes And Their Taxation In Oecd Countries

What Is Tax Evasion The Motley Fool

Pdf Trends In Top Incomes And Their Taxation In Oecd Countries

Sustainability Free Full Text Identifying Public Policies To Promote Sustainable Building A Proposal For Governmental Drivers Based On Stakeholder Perceptions Html

6 K 1 A03 5518 36k Htm 6 K Form 6 K Securities And Exchange Commission Washington D C 20549 Report Of Foreign Private Issuer Pursuant To Rule 13a 16 Or 15d 16 Of The Securities Exchange Act Of 1934 For The Month Of November 2003

Income Inequality In Israel A Distinctive Evolution Chapter 12 The Israeli Economy 1995 2017

Taxing Capital And Labor When Both Factors Are Imperfectly Mobile Internationally Springerlink

1 General Assessment Of The Macroeconomic Situation Oecd Economic Outlook Volume 2021 Issue 2 Oecd Ilibrary

If You Re A Younger Worker In Australia Don T Be Fooled On Tax Cuts Greg Jericho The Guardian

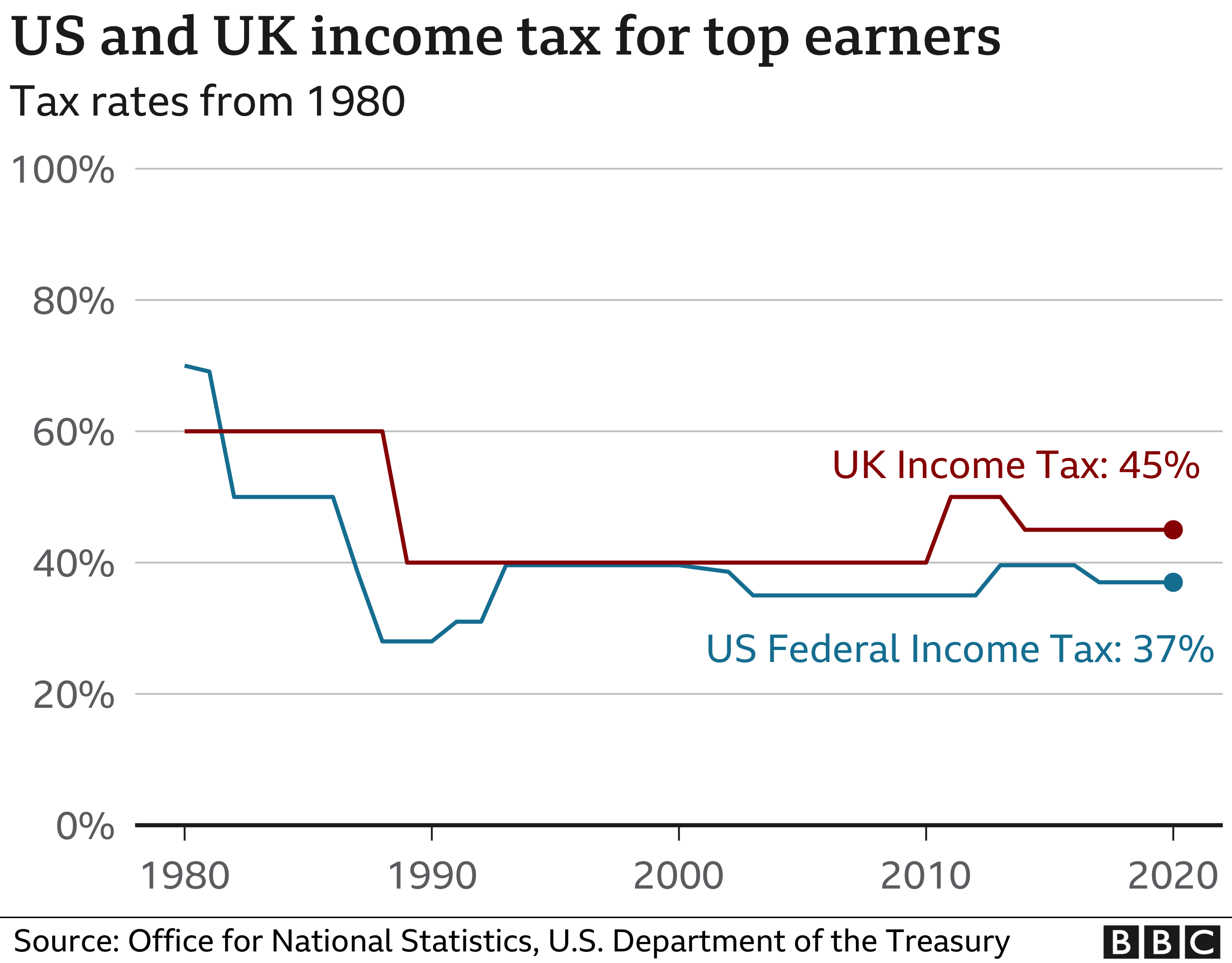

Trump Taxes A Fundamentally Unfair System Bbc News